Introduction

Managing your finances might not be the most exciting task, but it’s essential. With the right tools, it can also be a lot easier. Personal finance apps and tools have revolutionized the way we handle money, making it possible to track spending, set budgets, and even invest with just a few taps on your smartphone.

However, how can one select the finest alternative when there are so many to choose from? Whether you’re just getting started or looking to optimize your financial management, this article will guide you through the top 10 personal finance apps and tools.

Budgeting Apps

Mint

Mint is a widely recognized budgeting app that stands out for its intuitive design and extensive functionality. As a free app, Mint provides a robust suite of features aimed at helping users manage their personal finances effectively. It allows you to track your expenses, set and adhere to budgets, and even monitor your credit score—all from one convenient platform.

Key Features

- Automatic Syncing with Bank Accounts and Credit Cards: Mint automatically syncs with your bank accounts and credit cards, ensuring your financial data is up-to-date without manual input. This feature helps in accurately tracking your spending and staying on top of your financial health.

- Budgeting Tools with Customizable Categories: The app offers flexible budgeting tools where you can create and manage budgets based on customizable categories. This personalization allows you to tailor your budgeting approach to fit your unique financial goals and spending habits.

- Bill Reminders and Alerts: Mint sends reminders and alerts for upcoming bills and due dates, helping you avoid late fees and manage your payments more effectively.

- Free Credit Score Monitoring: The app provides free access to your credit score and credit report, giving you insights into your credit health and helping you take steps to improve it if needed.

Pros and Cons

Pros:

- Easy to Set Up and Use: Mint’s user-friendly interface makes it straightforward to get started and navigate through its various features.

- Comprehensive Overview of Your Finances in One Place: With its ability to aggregate all your financial data, Mint offers a holistic view of your financial situation, making it easier to track your overall financial health.

- No Cost to Use: Mint’s free model makes it an accessible option for those looking to manage their finances without incurring additional costs.

Cons:

- Ads Can Be Intrusive: As a free app, Mint displays ads which some users may find distracting or intrusive.

- Limited Investment Tracking Capabilities: While Mint excels in budgeting and expense tracking, its investment tracking features are relatively basic compared to some other financial tools.

YNAB (You Need A Budget)

YNAB adopts a proactive approach to budgeting by encouraging users to “give every dollar a job.” This philosophy is ideal for individuals who prefer a hands-on approach to managing their finances and want to be deeply involved in their budgeting process.

Financial Trading 101: Proven Strategies, Technology, and Market Insights

Key Features

- Zero-Based Budgeting Method: YNAB employs a zero-based budgeting approach where every dollar of your income is assigned a specific purpose, ensuring you have a clear plan for your money and avoiding overspending.

- Goal Tracking and Detailed Financial Reports: The app allows users to set financial goals and track their progress, providing detailed reports and insights to help you stay on target.

- Bank Syncing and Transaction Importing: YNAB supports bank syncing and transaction importing, which simplifies the process of tracking expenses and reconciling your budget.

Pros and Cons

Pros:

- Highly Effective for Controlling Overspending: YNAB’s methodical approach to budgeting helps users stay disciplined and effectively manage their spending.

- Strong Educational Resources and Community Support: The app provides extensive educational materials and has a supportive community, helping users learn and improve their budgeting skills.

Cons:

- Subscription Fee After a Free Trial: YNAB requires a subscription fee after a free trial period, which might be a consideration for those looking for a free budgeting solution.

- Steeper Learning Curve Compared to Other Apps: The app’s comprehensive approach can be more complex to learn, which may pose a challenge for new users or those accustomed to simpler budgeting tools.

Expense Tracking Apps

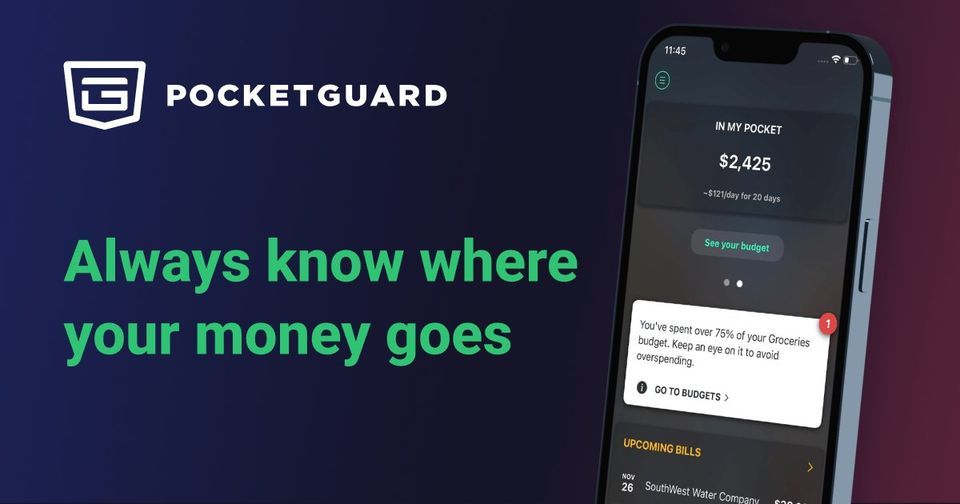

PocketGuard

PocketGuard is a budgeting app designed to make expense tracking straightforward by focusing on the amount of disposable income you have available. It helps you manage your finances by showing how much “pocket money” you have left after accounting for bills, financial goals, and necessities. This approach simplifies the budgeting process by highlighting how much you can comfortably spend without overspending.

Key Features

- Automatic Categorization of Expenses: PocketGuard automatically categorizes your expenses into different categories, which helps you quickly see where your money is going and ensures more accurate tracking.

- Bill Tracking and Negotiation Services: The app not only tracks your bills but also offers services to help you negotiate better rates on recurring expenses like cable, internet, and insurance, potentially saving you money.

- Personalized Insights into Spending Habits: PocketGuard provides insights into your spending patterns and offers recommendations for better financial management based on your habits.

Pros and Cons

Pros:

- Simplifies Budgeting with a Focus on Disposable Income: By concentrating on how much money you have left to spend after covering your essentials, PocketGuard makes budgeting less overwhelming and easier to manage.

- User-Friendly Interface: The app’s clean and intuitive design makes it easy to use, even for those new to budgeting apps.

Cons:

- Limited Customization for Budget Categories: Users looking for highly customizable budget categories might find PocketGuard’s options somewhat restrictive compared to other apps.

- Advanced Features Require a Subscription: While the basic features are free, accessing more advanced functionalities, such as detailed insights and negotiation services, requires a subscription.

Step-by-Step Approaches to Building Wealth That Lasts -2025

Goodbudget

Goodbudget brings the traditional envelope budgeting system into the digital age. The app allows users to allocate funds to specific envelopes for different expenses, helping you stick to your budget by controlling your spending in each category.

Key Features

- Digital Envelope Budgeting: Goodbudget uses the envelope budgeting method, where you set aside a specific amount of money for various spending categories. This system helps you manage and track your expenditures by ensuring that you do not exceed the allocated amounts for each category.

- Debt Tracking and Payoff Goal Setting: The app includes tools for tracking your debt and setting goals for paying it off, helping you stay motivated and organized in your journey to becoming debt-free.

- Syncing Across Multiple Devices: Goodbudget supports syncing your budget across multiple devices, making it easy to access and update your budget from anywhere.

Pros and Cons

Pros:

- Simple and Effective for Envelope Budgeting Enthusiasts: Goodbudget’s digital envelope system is perfect for those who prefer this traditional method of budgeting and want to maintain the discipline of allocating funds for specific expenses.

- Free Version Available with Essential Features: The app offers a free version that includes core budgeting features, making it accessible without requiring an initial investment.

Cons:

- Manual Entry of Transactions Can Be Time-Consuming: Unlike apps with automatic syncing, Goodbudget requires users to manually enter transactions, which can be more time-consuming and less convenient.

- Lacks Automatic Bank Syncing: The absence of automatic bank syncing means users need to manually update their transactions and balances, which might not be ideal for those seeking a more automated solution.

Saving and Investing Apps

Acorns

Acorns simplifies the investing process by automatically rounding up your everyday purchases to the nearest dollar and investing the spare change into diversified portfolios. This approach makes it easy for users to start investing without having to think about it actively, as the app integrates seamlessly with your spending habits to grow your investments over time.

Key Features

- Automated Investing with Round-Ups: Acorns’ standout feature is its automatic round-up system. When you make a purchase, the app rounds up the total to the nearest dollar and invests the difference. For example, if you buy a coffee for $3.75, Acorns will round it up to $4.00 and invest the $0.25 difference.

- Educational Content Tailored for Beginners: Acorns offers a range of educational resources aimed at helping new investors understand the basics of investing. This content includes articles, tips, and guides designed to build your financial literacy and confidence.

- Retirement Account Options (IRA): In addition to standard investment accounts, Acorns provides options for retirement accounts, such as IRAs. This allows users to invest for their future while taking advantage of tax benefits associated with retirement savings.

How to Read and Master the Statement of Stockholders’ Equity: A Step-by-Step Guide -2025

Pros and Cons

Pros:

- Easy to Start Investing with Small Amounts: The round-up feature allows users to start investing with minimal amounts, making it accessible for those who might not have large sums to invest initially.

- No Need for Prior Investment Knowledge: Acorns handles the investment decisions for you, making it an excellent option for beginners who may not have prior investment knowledge or experience.

Cons:

- Monthly Fees Can Outweigh Gains for Small Accounts: Acorns charges a monthly fee, which could potentially diminish your investment returns, especially if you have a small account balance or make only modest contributions.

- Limited Control Over Investment Choices: Users have limited control over the specific investments within their portfolio, as Acorns uses pre-designed portfolios based on your risk tolerance and financial goals.

Robinhood

Robinhood is a popular commission-free investing app that caters to both beginners and seasoned investors. It provides a wide array of investment options, including stocks, ETFs, and cryptocurrencies, all without charging commissions, making it a go-to platform for many looking to invest with minimal cost.

Key Features

- Commission-Free Trading: Robinhood eliminates trading commissions, allowing users to buy and sell stocks, ETFs, options, and cryptocurrencies without incurring fees on trades.

- Access to Stocks, ETFs, Options, and Cryptocurrencies: The app offers a broad range of investment options, including traditional assets like stocks and ETFs, as well as newer asset classes like cryptocurrencies, giving users the flexibility to diversify their portfolios.

- User-Friendly Interface with Real-Time Market Data: Robinhood’s platform is known for its sleek, user-friendly design and provides real-time market data, making it easy to monitor investments and execute trades quickly.

Pros and Cons

Pros:

- No Commissions on Trades: By removing trading fees, Robinhood lowers the cost of investing, which can be especially beneficial for frequent traders and those with smaller investment amounts.

- Easy-to-Use Platform with Educational Resources: The app is designed to be intuitive, even for beginners. It also provides educational resources to help users understand various investment strategies and market trends.

Cons:

- Limited Customer Support: Robinhood has faced criticism for its customer service, with users sometimes reporting long response times and difficulties resolving issues.

- Concerns Over Order Execution Quality: There have been concerns regarding the quality of order execution on Robinhood, with some users experiencing delays or discrepancies in trade executions. This issue can impact the effectiveness of trading strategies and overall user experience.

Debt Management Apps

Tally

Tally is a debt management app designed to help users pay down credit card debt more efficiently. The app simplifies the debt repayment process by managing your payments and offering a lower-interest line of credit to consolidate your existing credit card debt. This approach can help reduce the amount you pay in interest and expedite your journey to becoming debt-free.

Key Features

- Credit Card Payment Management: Tally takes over the task of managing your credit card payments. It prioritizes your payments based on interest rates and due dates, ensuring that you make the most efficient payments to minimize interest and avoid late fees.

- Low-Interest Debt Consolidation: One of Tally’s key features is its ability to provide a lower-interest line of credit. By consolidating your high-interest credit card debt into this lower-interest line, you can save money on interest and pay down your debt faster.

- Personalized Payoff Plans: The app offers customized payoff plans based on your financial situation and debt profile. These plans are designed to help you reduce your debt as quickly as possible while staying within your budget.

Pros and Cons

Pros:

- Simplifies Debt Repayment: Tally streamlines the debt repayment process by managing your payments and consolidating debt, making it easier to stay organized and make progress toward reducing your debt.

- Potential Savings on Interest: By offering a lower-interest line of credit to replace higher-interest credit card debt, Tally can help you save money on interest payments over time.

Cons:

- Not Available in All States: Tally’s services are not available in every state, which can limit accessibility for potential users depending on their location.

- Requires a Credit Check to Qualify for a Line of Credit: To access Tally’s lower-interest line of credit, you must undergo a credit check. This requirement may be a barrier for individuals with lower credit scores or limited credit history.

Unfortunatley Tally App is Closing its door now.

Credit Karma

Credit Karma is widely recognized for providing free credit score monitoring and educational resources. While it’s best known for offering access to your credit score and report, Credit Karma also provides tools and recommendations to help you manage your debt and improve your credit profile.

Key Features

- Free Credit Score and Report Access: Credit Karma offers free access to your credit score and credit report, allowing you to regularly monitor your credit health without incurring any costs.

- Credit Score Simulation Tools: The app includes tools that simulate how different financial actions might affect your credit score. This feature helps you understand the potential impact of various decisions on your credit.

- Personalized Recommendations for Financial Products: Based on your credit profile, Credit Karma provides personalized recommendations for credit cards, loans, and other financial products that may be beneficial for you.

Pros and Cons

Pros:

- Completely Free to Use: Credit Karma offers its services at no cost, providing access to credit scores, reports, and educational resources without charging users.

- Useful Insights into Credit Score Factors: The app provides valuable information about what factors influence your credit score and how you can improve it, helping you make informed financial decisions.

Cons:

- Advertisements for Financial Products: Credit Karma generates revenue through advertisements for financial products. Some users may find these ads intrusive or feel that they impact the user experience.

- Limited to Monitoring and Education, Not Direct Debt Management: While Credit Karma offers useful tools and information, it does not provide direct debt management services or personalized debt repayment plans, which may limit its utility for those seeking more hands-on assistance with debt reduction.

Retirement Planning Tools

Personal Capital

Personal Capital is a robust financial management tool designed to provide a comprehensive view of your financial health. It offers a suite of features aimed at retirement planning, investment tracking, and overall wealth management, making it a valuable resource for those looking to gain detailed insights into their financial future.

Key Features

- Retirement Planner with Future Projections: Personal Capital’s retirement planner helps you estimate your future retirement needs and projections. It evaluates your current savings, income, and investment strategies to provide an overview of whether you are on track to meet your retirement goals.

- Investment Tracking and Analysis: The app offers detailed tracking of your investment portfolio, including performance analysis and asset allocation. It helps you monitor your investments across different accounts and provides insights into how they are performing relative to your goals.

- Fee Analyzer for Investment Accounts: Personal Capital includes a fee analyzer that assesses the fees associated with your investment accounts. By identifying and quantifying these fees, it helps you understand how they impact your overall returns and provides guidance on reducing unnecessary expenses.

Pros and Cons

Pros:

- Detailed Insights into Your Retirement Planning: Personal Capital’s retirement planner provides in-depth analysis and projections, allowing you to make informed decisions about your retirement strategy and adjust your plans as needed.

- Free Tools with Premium Advisory Services Available: The app offers a range of free financial tools, with the option to access premium advisory services for more personalized financial guidance and management.

Cons:

- Limited Budgeting Features Compared to Other Apps: While Personal Capital excels in retirement and investment tracking, it lacks some of the comprehensive budgeting features found in other personal finance apps.

- Premium Services Can Be Costly: Accessing the premium advisory services, which include personalized financial advice and portfolio management, comes with a cost that may not be suitable for all users.

Fidelity Retirement Score

Fidelity’s Retirement Score tool provides a snapshot of your current retirement planning status, offering personalized recommendations based on your financial situation. It is designed to help users quickly assess their retirement readiness and identify areas for improvement.

Key Features

- Retirement Readiness Score: The tool calculates a score that reflects your preparedness for retirement based on factors such as savings, investment strategy, and future income needs. This score helps you gauge how well you are positioned to meet your retirement goals.

- Personalized Action Plans: Based on your score, Fidelity provides tailored action plans to improve your retirement readiness. These plans include recommendations for adjusting your savings rate, investment strategy, and other aspects of your retirement planning.

- Integration with Fidelity Accounts for Detailed Tracking: The Retirement Score tool integrates with your Fidelity accounts, allowing for detailed tracking and analysis of your retirement assets and progress.

Pros and Cons

Pros:

- Easy to Understand and Use: The tool is designed to be user-friendly, providing clear and concise insights into your retirement readiness and making it easy to follow the recommended actions.

- Tailored Advice for Improving Retirement Readiness: The personalized action plans offer specific guidance based on your individual financial situation, helping you make targeted improvements to your retirement strategy.

Cons:

- Best Suited for Fidelity Account Holders: The tool is most effective for users who hold accounts with Fidelity, as it leverages account data for more accurate tracking and recommendations. Non-Fidelity account holders may not benefit as fully from the tool’s features.

- Limited to Retirement Planning Without Broader Financial Tools: While the Retirement Score tool is excellent for evaluating retirement readiness, it does not offer a broader range of financial tools for general budgeting or investment management.

Other Notable Mentions

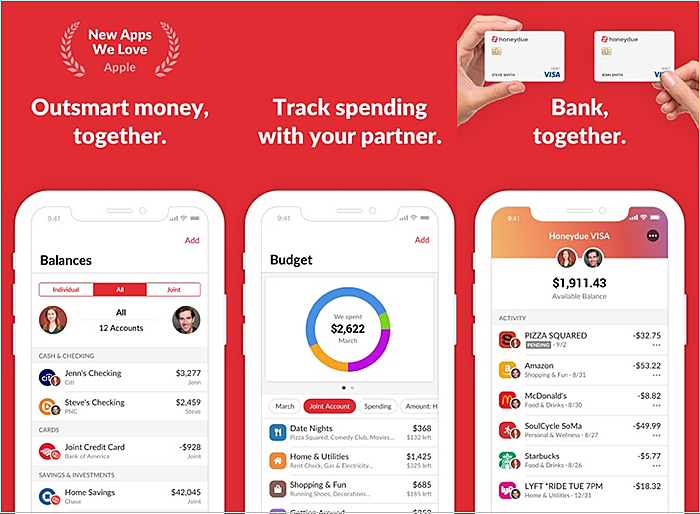

Honeydue

Honeydue is an app for couples to manage their finances together. It tracks both individual and joint expenses, helps set shared budgets, and sends reminders for upcoming bills. The app also categorizes expenses and provides spending insights, aiding in identifying savings opportunities. Additionally, Honeydue facilitates communication between partners by allowing them to discuss financial matters within the app.

Albert

Albert is a versatile finance app offering budgeting, saving, and investing tools. Users can create personalized budgets, automate savings, and access various investment options. Albert also features Albert Genius, a premium service that provides personalized financial advice and cash advances for urgent needs. This all-in-one platform helps users manage their finances efficiently.

How to Choose the Right App for You

When choosing a personal finance app, it’s essential to start by identifying your financial goals. Are you looking to budget better, save more, invest wisely, or manage debt? Once you’ve identified your goals, compare the features and user interfaces of different apps to see which one suits your needs. Don’t forget to consider the costs associated with premium features or subscriptions, as these can add up over time.

Conclusion

The right personal finance app can make a world of difference in how you manage your money. From budgeting and expense tracking to saving, investing, and debt management, there’s an app for every financial need. By choosing the right tool, you’ll be better equipped to take control of your finances, reach your goals, and ultimately achieve financial freedom.

FAQs

What are the best personal finance apps for beginners?

Mint and YNAB are great for beginners due to their user-friendly interfaces and comprehensive features.

Can I use more than one finance app?

Yes, using multiple apps can help you cover different aspects of your finances, such as budgeting, investing, and debt management.

Are these personal finance apps secure?

Most of these apps use bank-level encryption to protect your data. Always check the security features of an app before use.

Do I need to pay for premium features?

While many apps offer free versions, premium features may provide additional tools and insights. Evaluate whether the premium features are worth the cost for your needs.

How often should I check my Personal finance apps?

It’s a good habit to check your finance apps at least once a week to stay on top of your budget and track your progress toward financial goals.